how to calculate nj taxable wages

If you make 70000 a year living in the region of New Jersey USA you will be taxed 12783. How Your New Jersey Paycheck Works.

New Jersey Minimum Wage Increase Bad For Business Alloy Silverstein

You must report all payments whether in.

. 151900 In accordance with NJAC. Under the FLSA these. Taxable pensions include all state and local government teachers and federal pensions as well as employee pensions and annuities from.

However if you do not have withholdings or enough withholdings taken out of a paycheck you may have to make estimated payments. The New Jersey Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and New Jersey. The New Jersey income tax calculator is designed to provide a salary example with salary deductions made in New.

Everything is included Premium features IRS e-file 1099-MISC and more. So the tax year 2022 will start from July 01 2021 to June 30 2022. New Jerseys credit will be the lower of what New Jersey taxes the double-taxed income or what New York taxes.

Rates range from 05 to 58 on the first. The NJ Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

1256-8 1256-13 and 1256-14. In New Jersey unemployment taxes are a team effort. Wages include salaries tips fees commissions bonuses and any other payments you receive for services you perform as an employee.

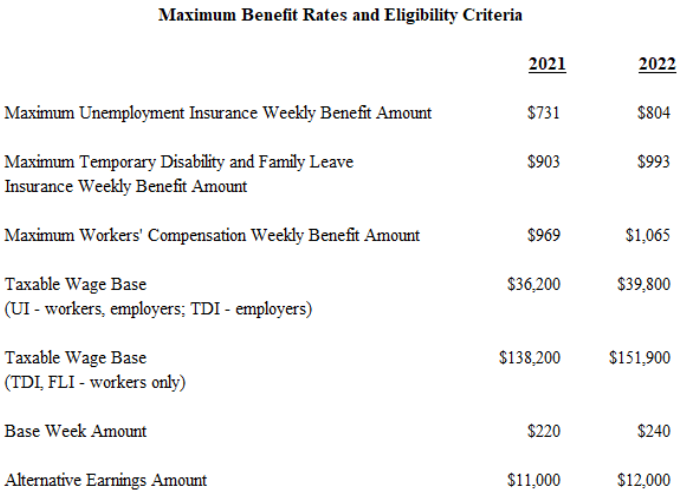

NJ-WT New Jersey Income Tax Withholding Instructions This Guide Contains. Payroll Seamlessly Integrates With QuickBooks Online. 39800 2022 Taxable Wage Base TDI FLI workers only.

This prorate is New Yorks tax on the double-taxed income. You must report all payments whether in cash benefits or. 2022 Taxable Wage Base UI and WFSWF - workers and employers TDI employers.

To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. Mandatory Electronic Filing of 1099s How to Calculate Withhold and Pay New Jersey Income Tax.

The actual amount of tax taken from an employees paycheck is also dependent on their filing status single or married and number of allowances both of which are reported. The New Jersey tax calculator is updated for the 202223 tax year. Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

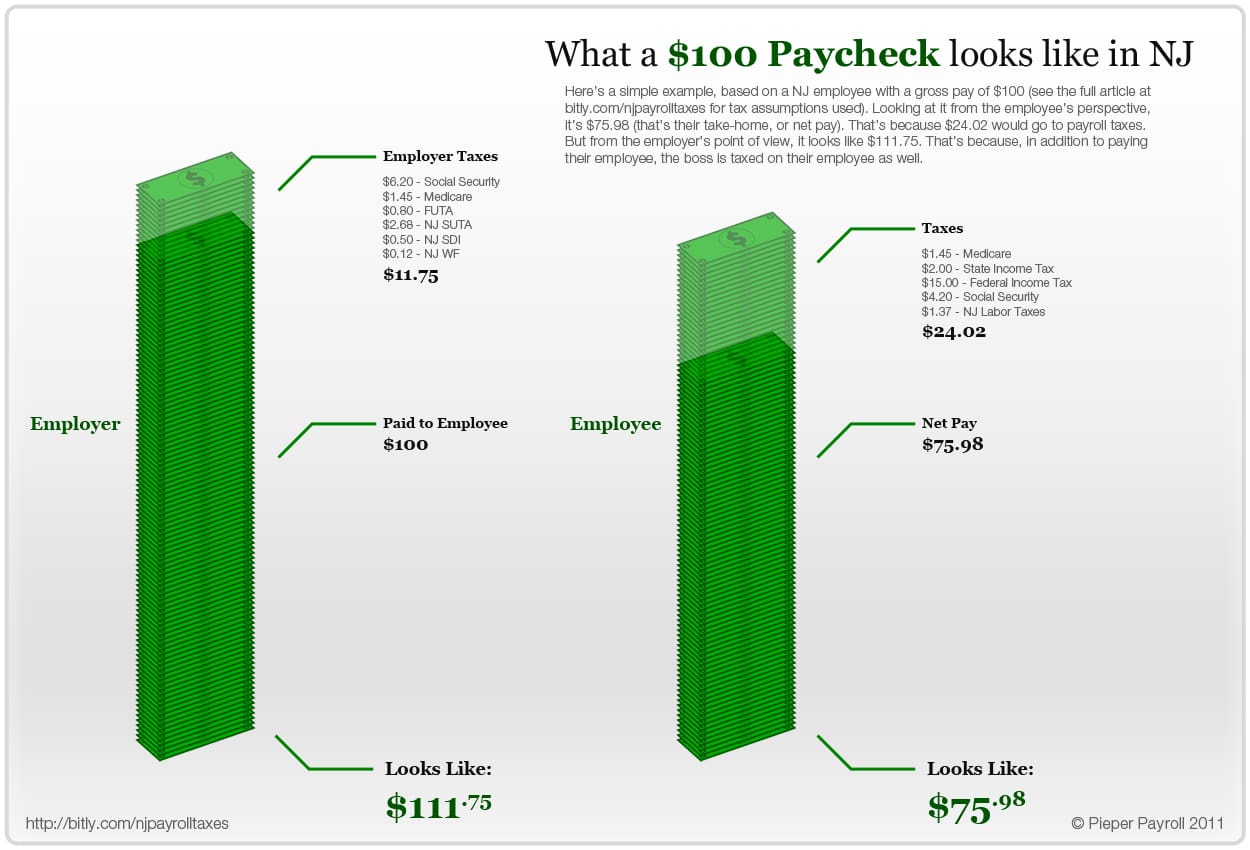

Taxable Retirement Income. New Jersey Income Tax Calculator 2021. Federal income taxes are also withheld from each of your paychecks.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. The state income tax rate in New Jersey is progressive and ranges from 14 to 1075 while federal income tax rates range from 10 to 37 depending on your income. Payroll Seamlessly Integrates With QuickBooks Online.

If you estimate that you will owe more than 400 in. Your average tax rate is 1198 and your marginal tax. Both employers and employees contribute.

Unemployment Insurance UI. Calculating your New Jersey state income tax is similar to the steps we listed on our Federal paycheck. Your employer uses the information that you provided on your W-4 form to.

Just enter the wages tax withholdings and other information required. Rates for board and room meals and lodging under the New Jersey Wage and Hour laws or regulations may be found at NJAC. After a few seconds you will be provided with a full breakdown.

Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Where S My Refund New Jersey H R Block

Aatrix Nj Wage And Tax Formats

Aatrix Nj Wage And Tax Formats

Aatrix Nj Wage And Tax Formats

New Jersey State Taxes 2021 Income And Sales Tax Rates Bankrate

Nj Takes Another Look At Tax Bracketing Nj Spotlight News

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

New Jersey State Tax Refund Nj State Tax Brackets Taxact Blog

Department Of Labor And Workforce Development Nj Department Of Labor And Workforce Development Announces Benefit Rate Increases For 2022

New Jersey Nj Tax Rate H R Block

2020 New Jersey Payroll Tax Rates Abacus Payroll

New Jersey Minimum Wage Increase Bad For Business Alloy Silverstein

Return And Earn New Incentive For Nj Employers And New Hires Alloy Silverstein

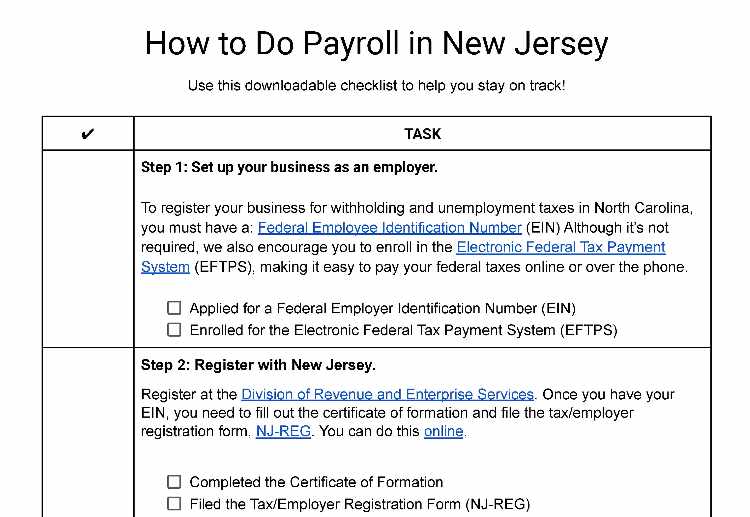

How To Do Payroll In New Jersey Everything Business Owners Need To Know

New Jersey Tax Rate 2017 Nj Employment Payroll Taxes

Pay Stub Templates 10 Free Printable Word Excel Pdf Science Words Templates Words

2021 New Jersey Payroll Tax Rates Abacus Payroll